Loan schedule

The loan schedule is created based on relevant interest and redemption data from the ISIN code.

The static data on the ISIN code is visible in the securities management system in the local platform. The loan schedule is visible to the participant when the ISIN is announced through the CSD.

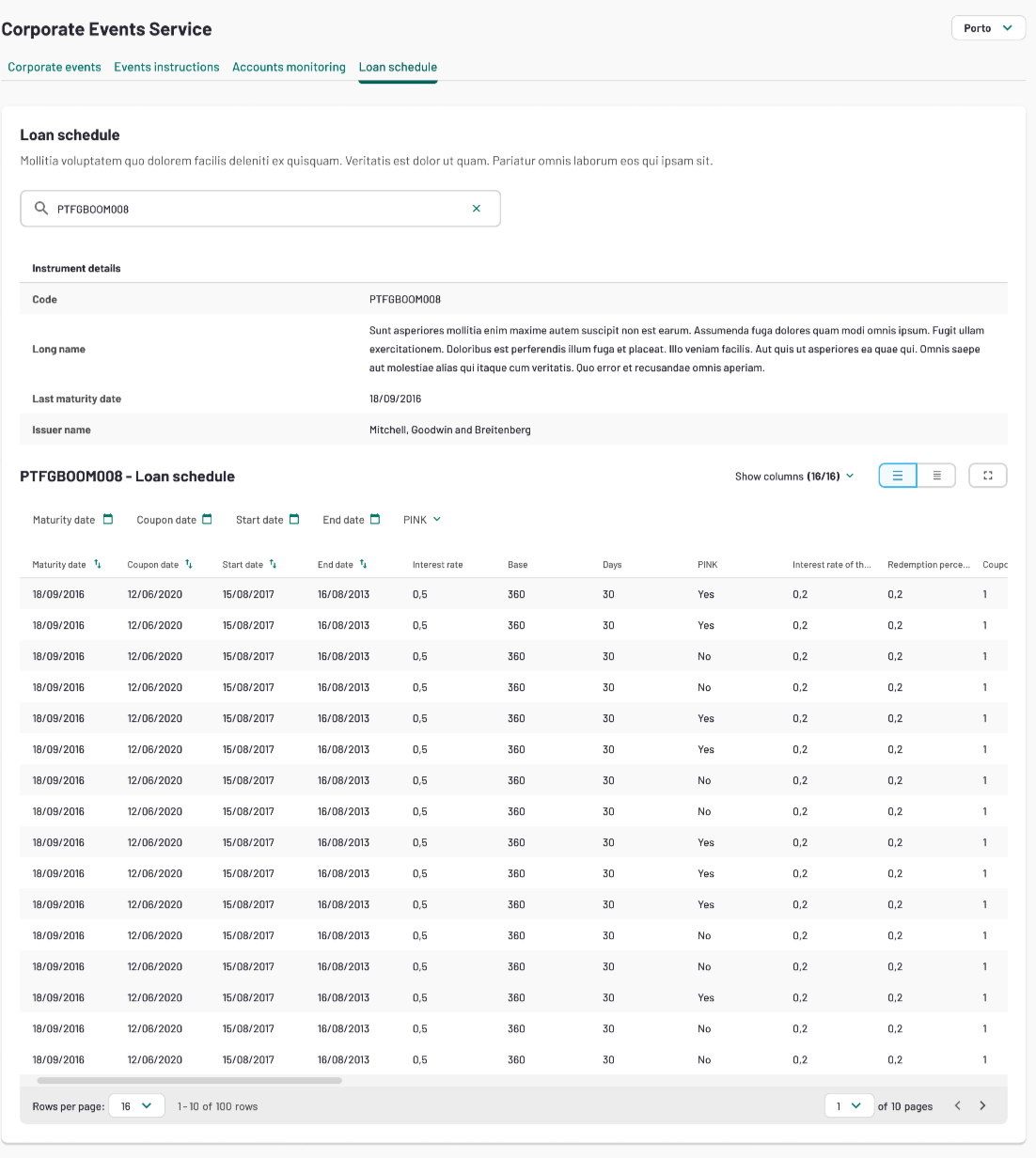

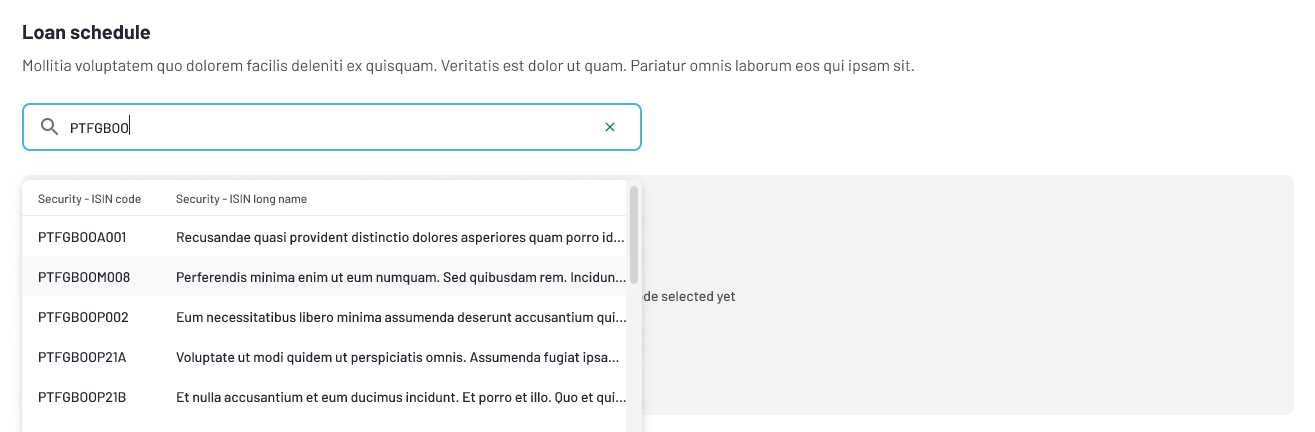

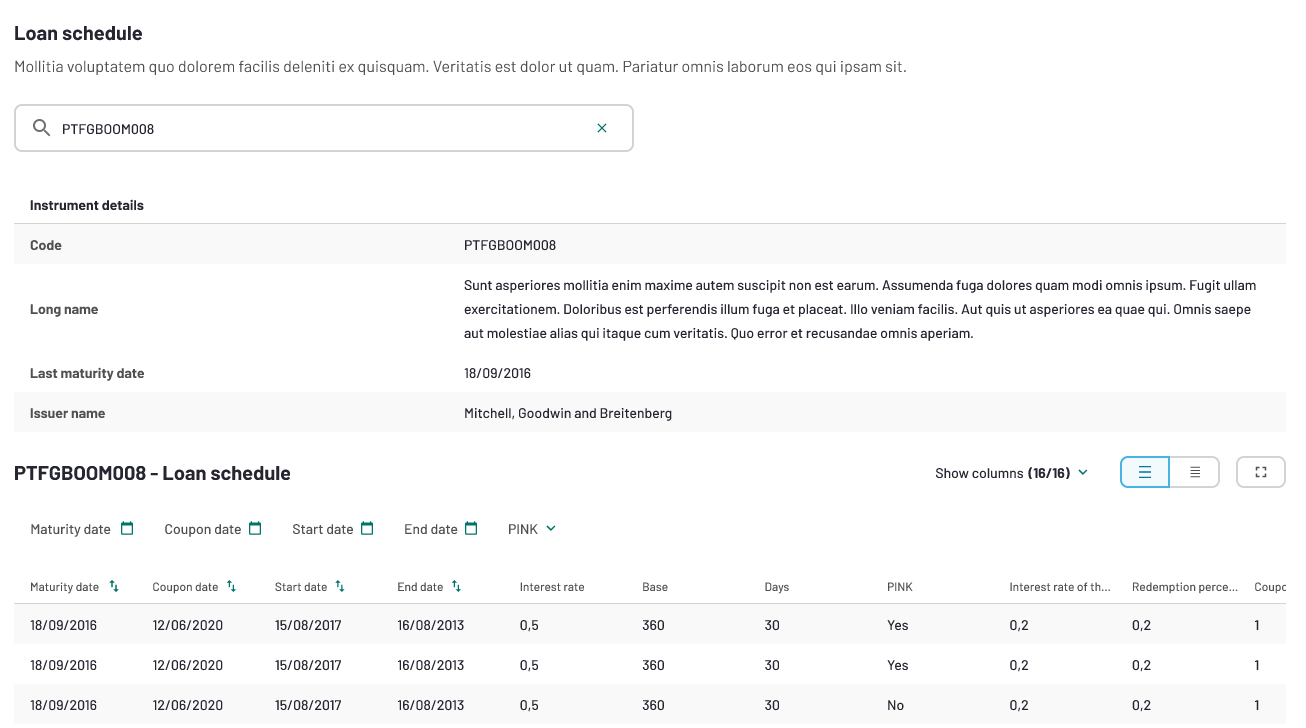

The participant can see the loan schedule of an ISIN by searching for one ISIN code.

When the participant start typing a code the possible ISIN codes and the long name of the ISIN codes will be shown.

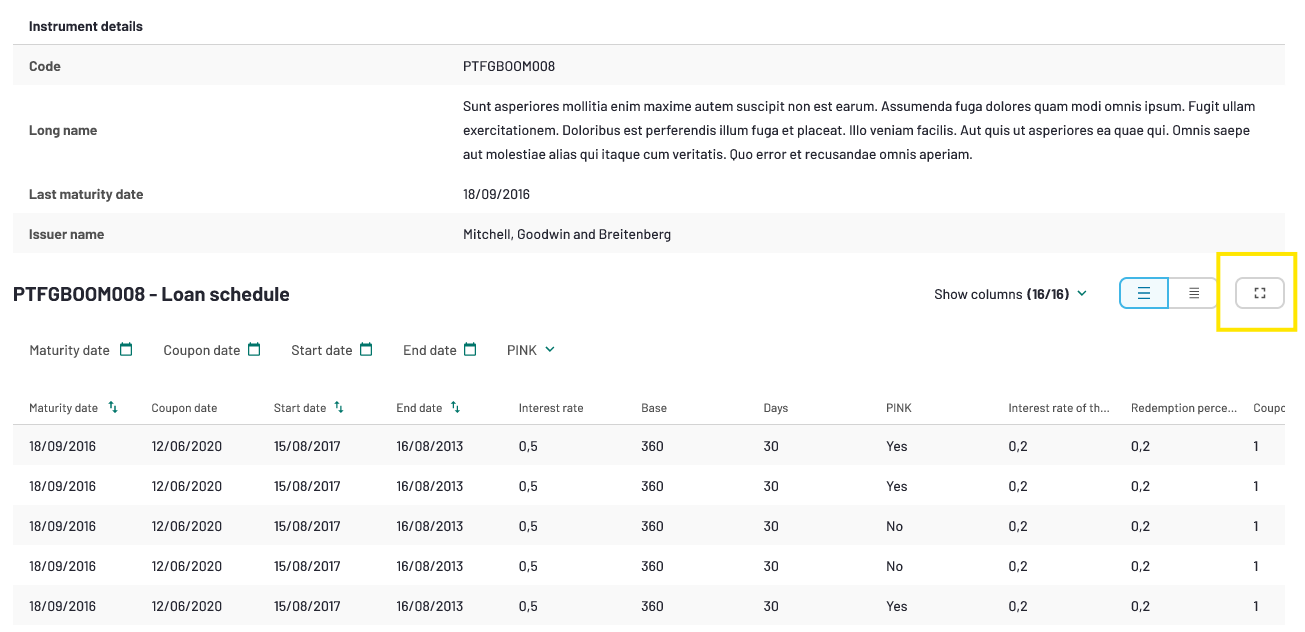

As the participant has chosen an ISIN code, the instrument details, code, long name, last maturity date and issuer name are showed in the top of the screen.

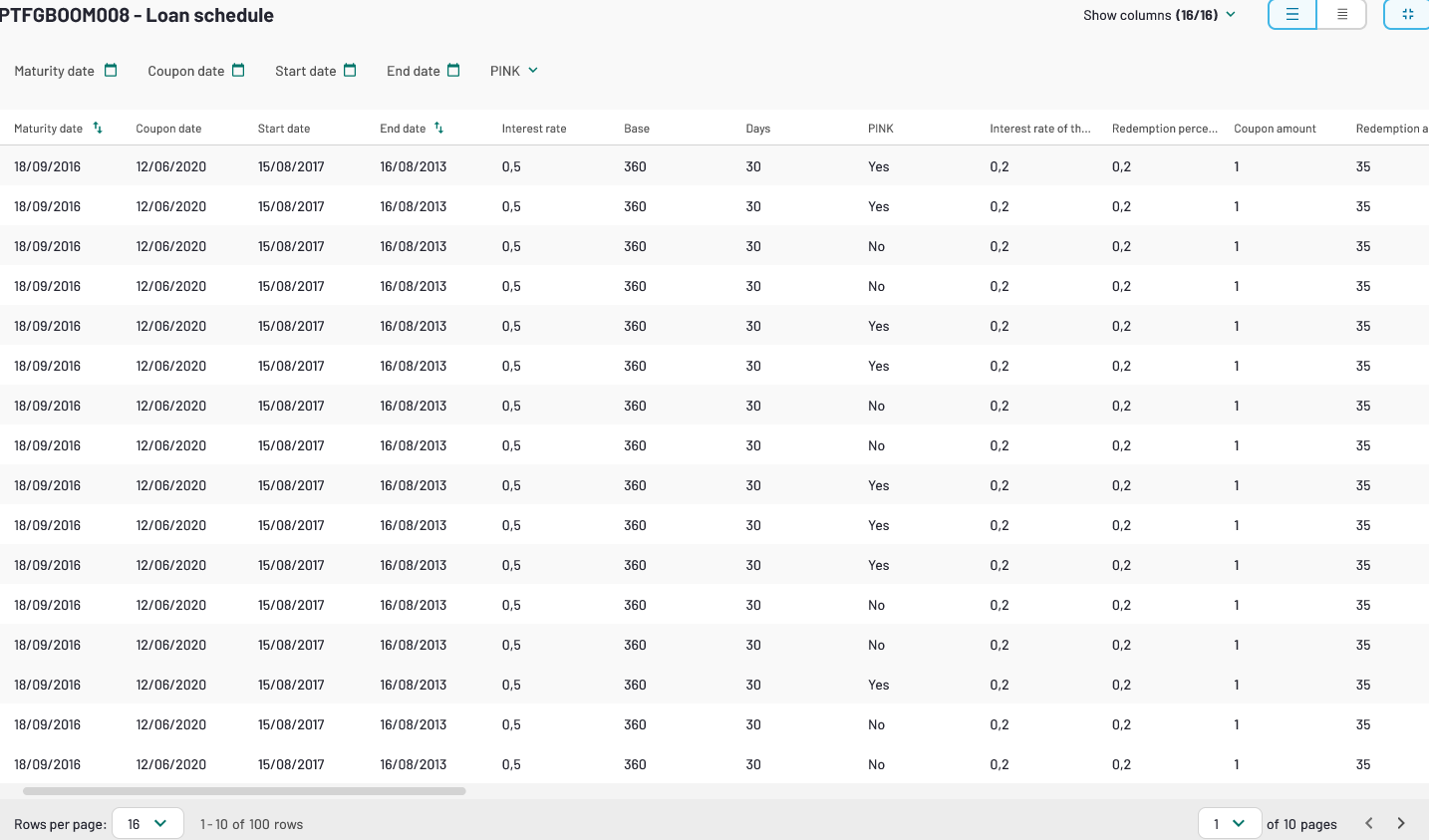

The loan schedule shows one period per line and if there is both a redemption and an interest for the same period it is showed in the same line.

If there is only an interest payment for a period only the fields relevant for an interest is filled out. As soon as an interest or redemption event is announced the corporate event is visible in the event list on the first page.

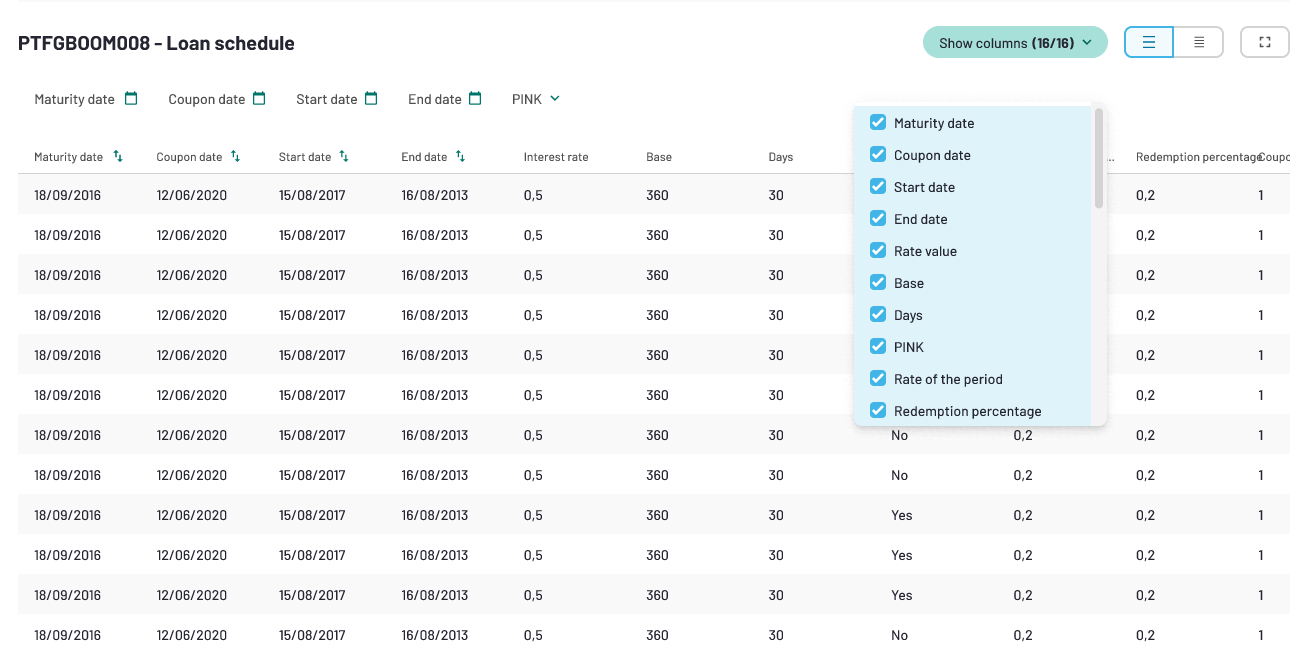

The participant can display the columns they want to see by clicking on "show columns" button. The following information can be visible:

- Maturity date

- Coupon date

- Start date

- End date

- Interest rate

- Base (Interest days per year)

- Days (Interest days in period)

- Pink

- Interest rate of the period

- Redemption percentage

- Redemption Price

- Currency

- Holiday treatment

The participant can filter by maturity date, Coupon date, Start date, End date and PINK clicking the arrow or calendar. Filters can be deleted by press Reset all filters.

The participant can use the full screen option to see more columns.

The participant can select which columns to hide or show.